Stock Market Outlook

For The Week Of August 6th = Uptrend

INDICATORS

-

ADX Directional Indicators: Uptrend

Price & Volume Action: Uptrend

Elliott Wave Analysis: Mixed

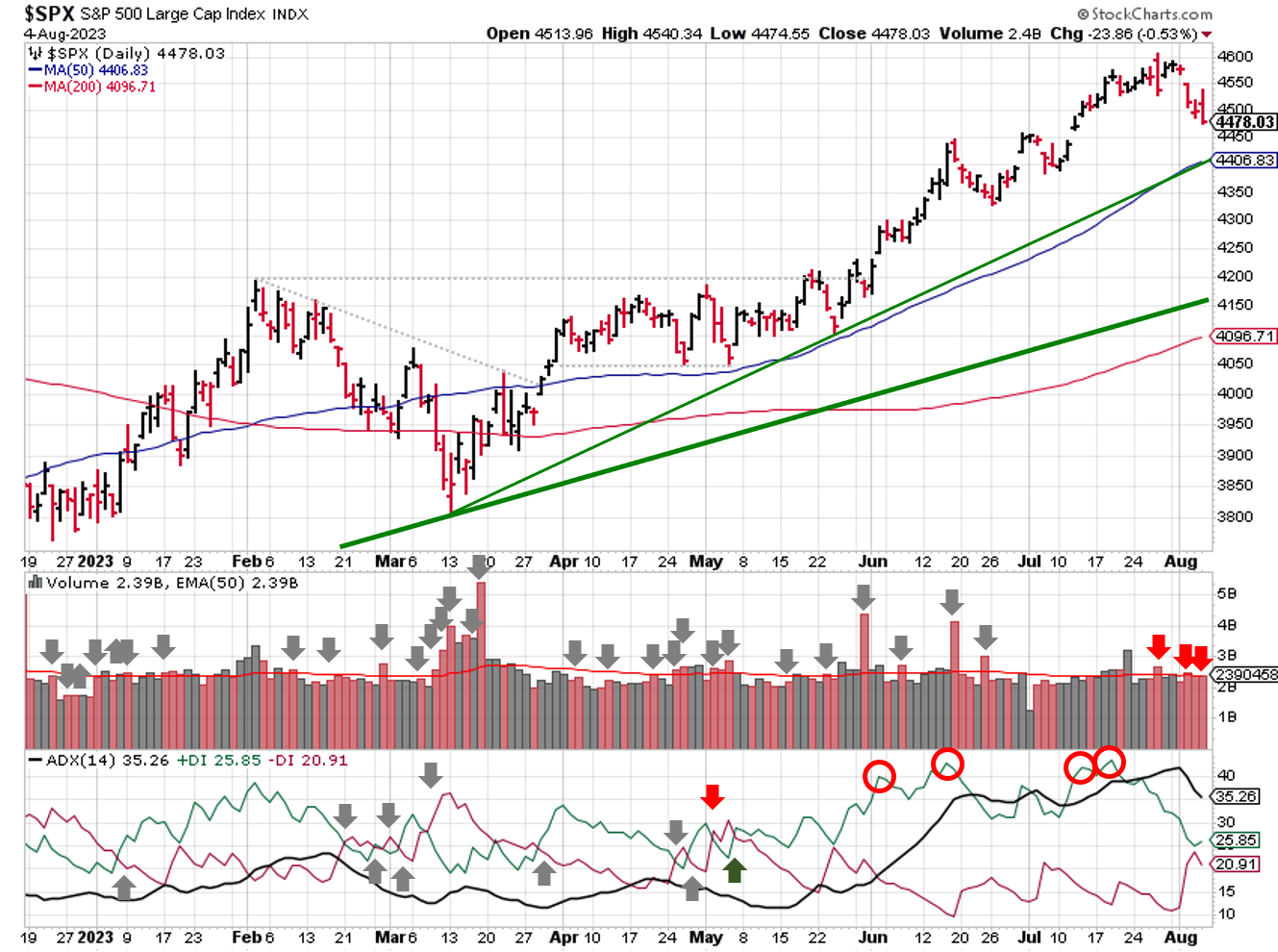

The S&P500 ($SPX) fell 2.3% last week. As of Friday's close, the index sat ~1.5% above the 50-day and 9% above the 200 day moving averages.

2023-08-06-SPX Trendline Analysis - Daily

No change from the ADX last week, although the directional indicators did converge significantly during the sell-off.

Price/volume also remains in an uptrend, while picking up 3 distribution days in the past 7 sessions. Friday's intraday reversal added a distribution day to the count, even though volume wasn't extended from Thursday's session.

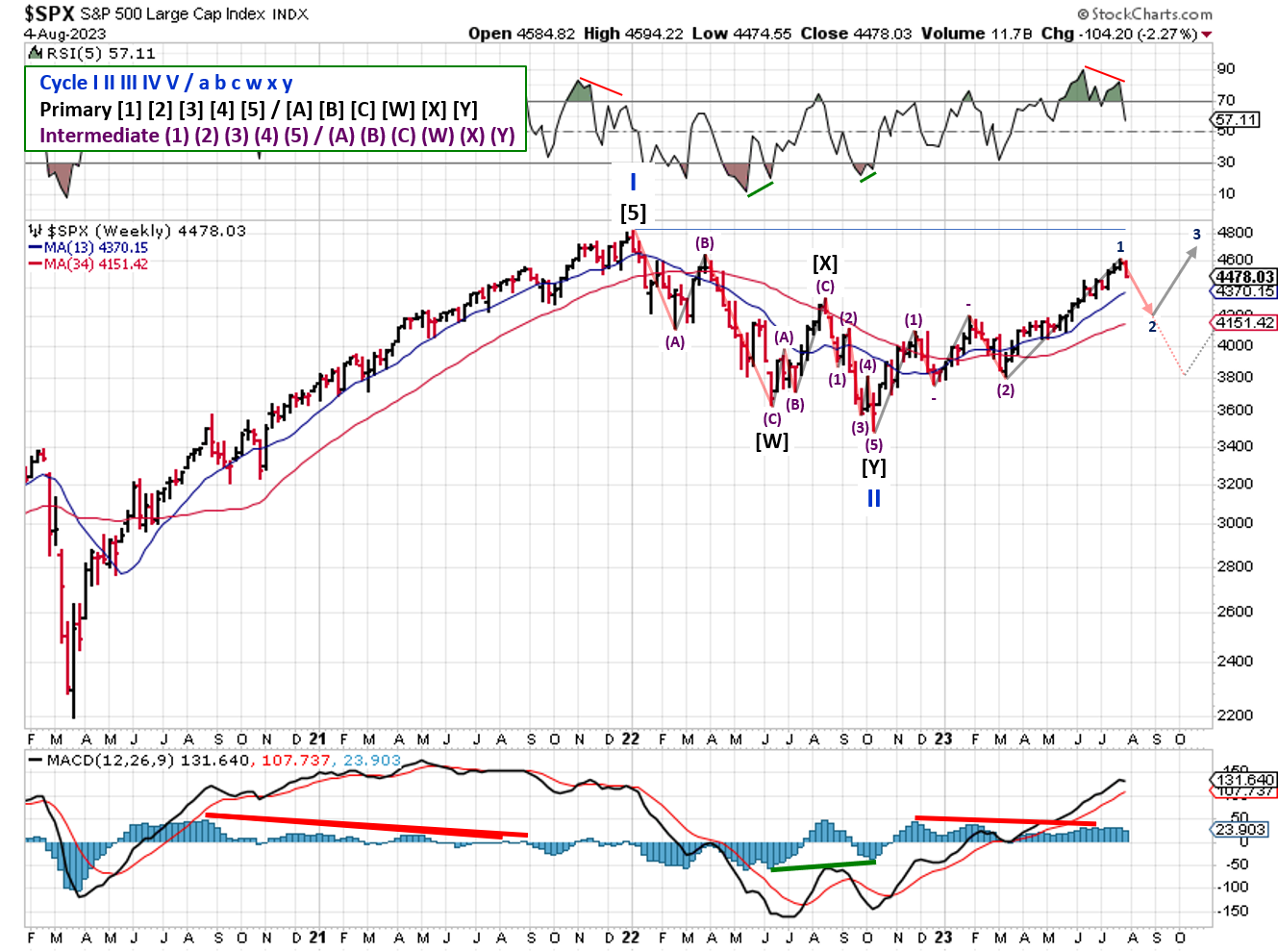

2023-08-06- SPX Elliott Wave Analysis - Daily

Both Elliott Wave counts show the market in the final stage of the recent rally. A negative divergence in both the RSI(5) and the MACD are bearish near-term, though key support and resistance levels remain unchanged (4169 and 4632).

2023-07-01- SPX Elliott Wave Analysis - Weekly - Primary 1 (Bullish)

Zooming out to the long-term view shows the rally extended for 5 weeks versus the last chart update in July.

2023-08-06- SPX Elliott Wave Analysis - Weekly - Primary 1 (Bullish)

If the market truly started a new bull market last October, Elliott Wave puts the next in the S&P500 somewhere between 4200 and 3800; roughly a ~7% to 18% drop from Friday's close.

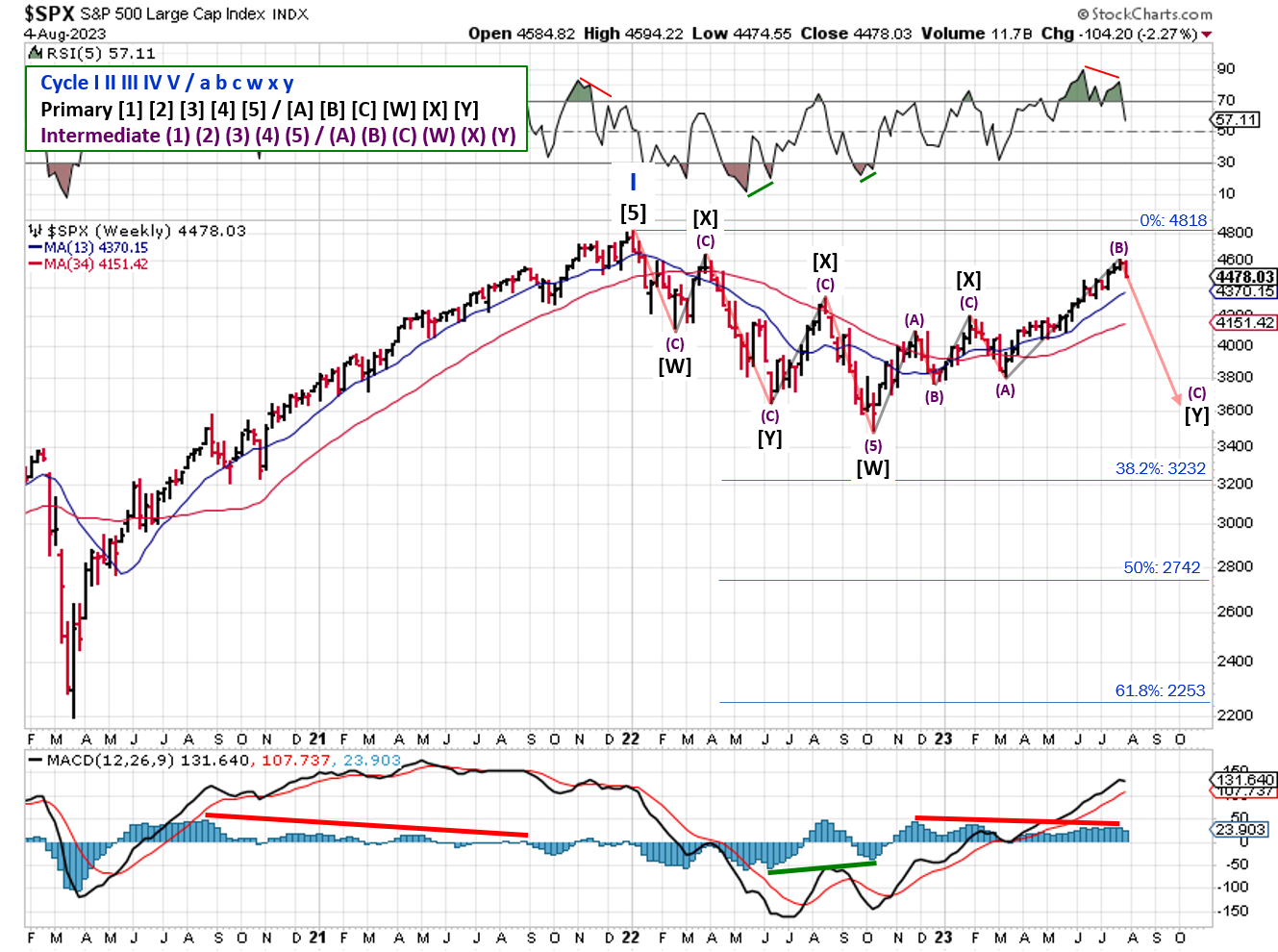

If the S&P500 just experienced a long, bear-market rally from October 2022, then the next wave completes somewhere below the March 2023 low of ~3800.

2023-08-06- SPX Elliott Wave Analysis - Weekly - Primary Y (Bearish)

COMMENTARY

On Tuesday, Fitch Ratings downgraded the Long-Term Foreign Currency IDR fpr the U.S. from AAA to AA+ (Fitch Downgrades the United States' Long-Term Ratings to 'AA+' from 'AAA'; Outlook Stable). IDR the abbreviation for Issuer Debt Rating. Per Fitch:

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance...has manifested in repeated debt limit standoffs and last-minute resolutions.

Based on that rationale, I'm surprised anyone was surprised! In the end, the rating change means that this risk of owning U.S. debt is slightly higher now, so interest rates will rise to compensate.

The Non-Farm Payrolls report for June was a mixed bag. Payrolls were up 187K, missing the consensus estimate for 200K. Unemployment dropped 10 basis points (3.6% to 3.5%), and average hourly earnings increased more than expected (+4.4% Y/Y). These data points, combined with last week's advanced GDP and PCE figures, are unlikely to dissuade the FOMC from raising rates again.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don't, tell an enemy.

Sources: Bloomberg, CNBC, Federal Reserve Bank of St. Louis, Hedgeye, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics

Share this Post on:

How to Make Money in Stocks: A Winning System in Good Times and Bad.

It's one of my favorites.

I regularly share articles and other news of interest on:

Twitter (@investsafely)

Facebook (@InvestSafely)

LinkedIn (@Invest-Safely)

Instagram (@investsafely)

Invest Safely, LLC is an independent investment research and online financial media company. Use of Invest Safely, LLC and any other products available through invest-safely.com is subject to our Terms of Service and Privacy Policy. Not a recommendation to buy or sell any security.

Charts provided courtesy of stockcharts.com.

For historical Elliott Wave commentary and analysis, go to ELLIOTT WAVE lives on by Tony Caldaro. Current counts can be found at: Pretzel Logic, and 12345ABCDEWXYZ

Once a year, I review the market outlook signals as if they were a mechanical trading system, while pointing out issues and making adjustments. The goal is to give you to give you an example of how to analyze and continuously improve your own systems.

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

- 2018 Performance - Stock Market Outlook

- 2019 Performance - Stock Market Outlook

- 2020 Performance - Stock Market Outlook

IMPORTANT DISCLOSURE INFORMATION

This material is for general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purpose. Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisors of his/her choosing. Invest Safely, LLC is not a law firm, certified public accounting firm, or registered investment advisor and no portion of its content should be construed as legal, accounting, or investment advice.

The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this website does not constitute a representation that the investments described herein are suitable or appropriate for any person.

Hypothetical Presentations:

Any referenced performance is “as calculated” using the referenced funds and has not been independently verified. This presentation does not discuss, directly or indirectly, the amount of the profits or losses, realized or unrealized, by any reader or contributor, from any specific funds or securities.

The author and/or any reader may have experienced materially different performance based upon various factors during the corresponding time periods. To the extent that any portion of the content reflects hypothetical results that were achieved by means of the retroactive application of a back-tested model, such results have inherent limitations, including:

Model results do not reflect the results of actual trading using assets, but were achieved by means of the retroactive application of the referenced models, certain aspects of which may have been designed with the benefit of hindsight

Back-tested performance may not reflect the impact that any material market or economic factors might have had on the use of a trading model if the model had been used during the period to actually manage assets

Actual investment results during the corresponding time periods may have been materially different from those portrayed in the model

Past performance may not be indicative of future results. Therefore, no one should assume that future performance will be profitable, or equal to any corresponding historical index.

The S&P 500 Composite Total Return Index (the "S&P") is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor's chooses the member companies for the S&P based on market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. The S&P is not an index into which an investor can directly invest. The historical S&P performance results (and those of all other indices) are provided exclusively for comparison purposes only, so as to provide general comparative information to assist an individual in determining whether the performance of a specific portfolio or model meets, or continues to meet investment objective(s). The model and indices performance results do not reflect the impact of taxes.

Investing involves risk (even the “safe” kind)! Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of underlying risk. Therefore, do not assume that future performance of any specific investment or investment strategy be suitable for your portfolio or individual situation, will be profitable, equal any historical performance level(s), or prove successful (including the investments and/or investment strategies describe on this site).