Selling Shares = Trading Assets for Money

If you're ready to start selling shares, CONGRATULATIONS!

You're one step away from actually making money...because up until this point, you haven't made any.

Sure, your account balance may be higher than it was when you started.

But until you start selling shares, you can't do anything with those gains (like buy that new car you've had your eye on).

That's why you commonly hear them referred to as paper gains...because you don't actually have the cash in your hands yet.

Placing Sell Orders

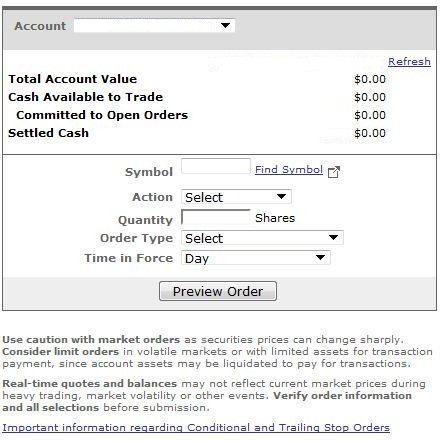

Just like when you log into your brokerage account to buy shares, you'll see the same interfaces, like this...

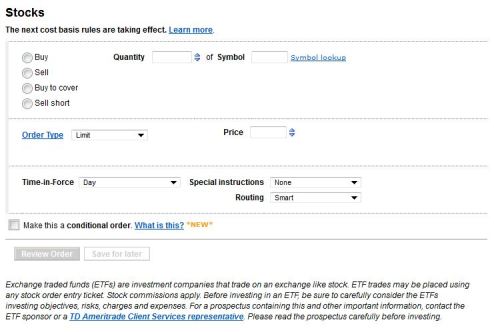

Or like this...

And just like when you're buying shares, you can enter orders to sell shares in a wide variety of ways, via different order types.

Now you will learn how to sell shares on the open market.

Safe Investing Tip:

Selling shares of a mutual fund is more straightforward, because mutual funds are only bought and sold at the end of a trading day. The closing price is the price you get, period.

3 Types of Sell Orders

There are 3 main types of orders you can place in the market for selling shares (they are the same types you use to buy shares):

- Market Orders

- Limit Orders

- Stop Orders

Market orders are submitted "as is", meaning that you get whatever price is assigned when you order is submitted. When you place a market order, you to buy or sell shares immediately, which is the next available price. As soon as the order is processes, it is going to be filled (as long as people are trading your investment).

For more information on placing market orders, click here.

Limit orders put a price restriction on the order, meaning that the price you pay must be equal or better than the price you specify with the order. When you place a limit order, you are specifying the highest price you are willing to pay or the lowest price you are willing to sell. Your order will be executed at your requested price or better if possible.

For more information on placing limit orders, click here.

Stop orders are the most stringent orders. they only become orders after a price has moved past the threshold you specify.

For more information on placing stop orders, click here.

Order Duration

When selling shares, you can specify how long to keep the order active. You can place a "Day Order", which means that your order to sell shares remains active until the end of the day you entered it. If you specify Good to Canceled (GTC), your sell order will remain open indefinitely(until you close the order or it is executed).

Quantity Instructions

All or None (AON) - Selling shares with an "All or None" order means that your entire order must be executed at the same time, or it does not get executed. For example, if you were selling 1000 shares at $50.00, the order would only execute if all 1000 shares could be sold at $50.00. The more shares in your order, the more likely it will be split between different prices.

Fill or Kill (FOK) - A "Fill or Kill" order means that you want to buy shares IMMEDIATELY. If the order cannot be filled immediately, in its entirety, it is automatically canceled.

Conditional Orders, Contingent Orders, and Special Instructions

Depending upon your broker, you can specify several special instructions that will affect how your order is placed.

For more information on placing conditions on your orders (called contingent orders), click here.