Grow your Assets and Shrink Your Liabilities with a Personal Balance Sheet

A personal balance sheet is a quick and easy way for you to see a snapshot of your finances in a given month. Basically, this statement shows what you own, and what you owe.

The term "balance sheet" refers to the fact that in the corporate world, a firm's assets must equal the firm's liabilities and stockholders' equity.

Assets = Liabilities + Stockholders' Equity

Stockholders' equity is defined as a firm's assets minus its liabilities. This is the same definition used for the term Net Worth.

So for a personal balance sheet, I rearrange the equation slightly, so that the concept is easier to understand:

Assets - Liabilities = Net Worth

In the personal finance world, you and your family are the shareholders, so you could use either term. The choice is yours.

Safe Investing Tip:

Looking for the personal balance sheet example? Scroll down to the bottom of the page and download your FREE template to help you get started!

Assets

As you can see in the equation above, assets are things that you own and increase your net worth. A simple way to think about it is that when you purchase or invest in assets, they pay you back over time.With a hat tip to Robert Kiyosaki and the Rich Dad Poor Dad book series, there are three types of assets that you can own for financial purposes: Real, Paper, and Passive.

You may notice that these are also the three types of income in the personal income statement.

I did this on purpose, to make it easier to the connection between income and assets when you go through the exercise of organizing your personal finances.

Real Assets

The real asset category includes things you can put your hands on...physical property that you own. I include rental property, precious metals, coins, stamps, art and other collectibles in this category.

Your home is NOT included in this category. Instead, I put my home in the "acquisitions" category (see below for more information).

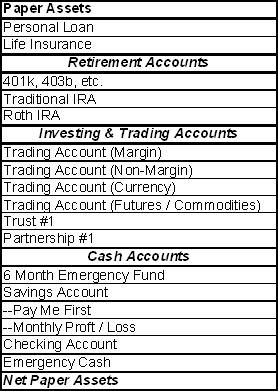

Paper Assets

Paper assets are stocks, bonds, derivatives (options, futures, etc.), and contracts. Essentially, these are all assets that are printed on paper, hence the term "paper" assets.

In the beginning of your safe investing journey, almost all of your assets are likely to be paper assets, or those associated with financial and investment instruments.

As you gain experience, you'll likely branch out into other areas as a way to "diversify" your holdings.

Click this link to go to my page on diversified investments.

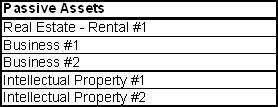

Passive Assets

Passive assets are those which produce passive income. A vast majority of these assets will not be directly owned by you or your family.

Instead, you will own a business, which in turn owns these assets.

The fact that a business owns these assets means that the profit, loss, and tax consequences do not need to be included in your personal financial statements.

Instead, these will be covered by your companies financial statements. You are just concerned with the income they produce.

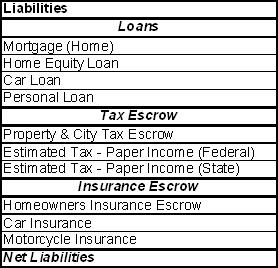

Liabilities

Assets are things you own, so liabilities are things that you owe or have a binding agreement to repay at some point in the future. They also decrease your net worth!

For example, if you own property, you also have an obligation to pay taxes on that property each year.

On my personal balance sheet, I take the annual tax I have to pay, and divide it by 12. I keep a running total each month, to show that this obligation continues to grow.

When I make a tax payment, I subtract the amount paid (usually 6 months of tax), to show that when the obligation is paid.

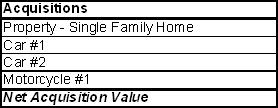

Acquisitions

I created this category to capture special kinds of "asset"; those that create liabilities and/or expenses in your balance sheet.

Earlier, I defined assets as physical things that increase your net worth. Everything on the above list COULD do that for you.

But they usually too expensive for you to just pay cash. Instead, you'll pay a small amount (down payment), and then get a loan to cover the rest of the payment. A loan is debt, which creates a liability.

An example of an acquisition is your home.

There are a ton of benefits that go along with home ownership. Since this site is about safe investing, I am only focused on how assets impact your personal balance sheet (financial benefits).

When a home increases in value, it contributes to your net worth, which makes it seem like an asset.

The difference makers are the liabilities and expenses that are created when you buy the home:

- Initial Downpayment

- Mortgage Payments (Principle + Interest)

- Homeowners Insurance

- Mortgage Insurance (PMI)

- Property and City Taxes

- Utility Bills

If you really want to say your home is an investment, then you need take all of these factors into account when you calculate the "value" of your investment.

Home Value = Selling Price - (Downpayment + Mortgage Pay-Off Amount + Total Mortgage Interest Paid + Total Insurance Premiums Paid + Total Taxes Paid + Total Maintenance Costs + Total Utility Costs)

Other "assets" (cars, motorcycles, boats, etc.) decrease in value over time, so they gradually decrease your net worth AND create liabilities (loans and insurance) and expenses (maintenance, registration, etc.)

Finally, when discussing you finances with your advisors, most will want to know what your net worth is with and without your home and vehicles. So it is good practice to see your net worth calculated both ways.