Are you Rich or Poor?

Organizing Personal Finances with Cashflow Diagrams Reveals All

Organizing personal finances can be a tricky task if you've never had any experience with financial statements or personal budgets.

But Robert Kiyosaki, best selling author of the Rich Dad Poor Dad series of books, developed a great (meaning simple) way to visualize your finances.

According to Mr. Kiyosaki, there are four key terms that you must understand in order to go about organizing personal finances properly:

- Income vs Expenses (Personal Income Statement)

- Assets vs Liabilities (Personal Balance Sheet)

Before we begin, please note that the following cashflow patterns are oversimplified, yet powerful examples.

Everyone has bills to pay in some form (taxes, food, gas, clothes, shelter, etc.), but organizing personal finances is unique for every person/family - all situations are different.

The illustrations are meant to show you a different way of thinking when it comes to organizing personal finances; a way that shows you where your money is going.

They represent how money "flows" through different types of financial situations.

And there is nothing wrong with any of these cashflow patterns. Poor, Middle Class, Rich, and Wealthy actually refer to your thoughts on money, not your income.

As you'll see, you can have a lot of money and be poor!

The importance lies in understanding the decisions that drive each one, along with the impact that they have on your personal financial health, so there are no surprises later on!

The fact that you're here, trying to learn how to better organize your personal finances is an encouraging sign.

When your finished organizing your personal finances, accept them as reality and say "OK, now what changes can I make?".

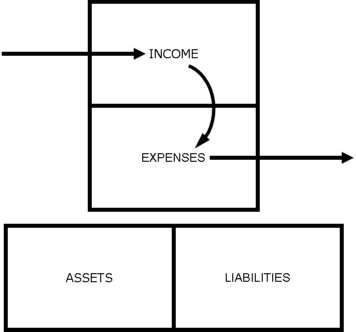

The Cashflow Pattern of the Poor

In this category, all of a persons income is earned (i.e. from a job), and a majority of that income is immediately spent on "things" or as Mr. Kiyosaki calls them; "Doodads".If you don't like the term "poor", think of this as the cashflow diagram of someone in high school or college. Their have money, so they spend it.

Cashflow Diagram indicating Poor Financial Health

This cashflow pattern corresponds to immediate gratification. Sadly, many people in their 30s and 40s have never "graduated" from this level.

All of their earned income is spent on things like expensive cars, iPhones, the latest computers, fast food and dining out, expensive clothes, and of course, taxes.

People who win millions of dollars from state lottery's tend to fall into this category.

On the bright side, this cashflow pattern does not have a lot of debt, which can make wealth easier to acquire!

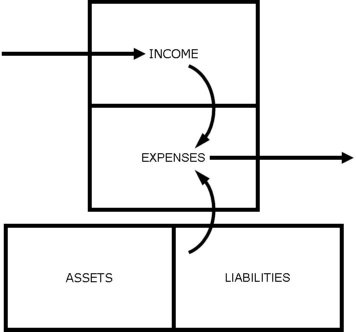

The Cashflow Pattern of the Middle-Class

The middle class is also dependent on earned income. People end up with this cashflow pattern by following the tradition advice that most of us have heard: Go to school, study hard, get good grades, go to college, get a "good" job, get married, have kids, etc.A "good" job really meant a "secure" job that would provide you with regular raises, health care, and a retirement plan.

Unless you've been living under a rock, you know that those things are no longer guaranteed.

Don't be that guy

[Source:www.geico.com]

In this pattern, there may be one OR two sources of earned income (e.g. DINKS - Dual Income, No Kids). Either way, with this cashflow patter, people begin to qualify for "credit".

Cashflow Diagram - Middle-Class Financial Health

So in addition to the expenses seen in the "poor" cashflow pattern, the middle class begin adding liabilities to their balance sheets.

Items such as mortgages, consumer loans (cars, boats, etc.), and credit cards begin creating additional expenses.

So even though the incomes are typically higher, the added liabilities created higher expenses as well.

For example, someone with a middle-class mindset might opt for a new house in an upscale neighborhood, driving the need for a large down payment, along with a large monthly mortgage payment.

And lets not forget the additional taxes, insurance, maintenance, utilities, etc.

For more information about the "true" cost of home ownership and how it relates to your financial statements, click here and scroll to the bottom of the page under "Acquisitions".

That new garage wouldn't look right without an expensive new car (what would the neighbors think?!), which requires a high interest rate consumer loan and insurance.

And with all these payments to make, a "good" job is a must, so working 12+ hours a day is also required.

Even though many professional athletes make millions of dollars every year, they actually have a middle class cashflow pattern, and are broke only a few years after they retire!

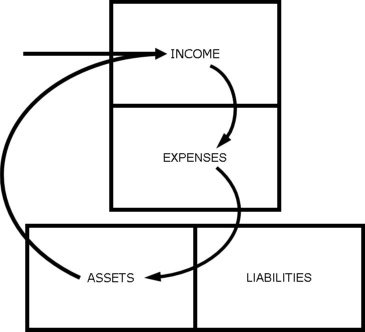

The Cashflow Pattern of the Rich

Being "rich" does not automatically mean that you have a gigantic salary. According the cashflow patterns, being rich means that you are focusing on buying assets that generate income.

Cashflow Diagram - "The Rich"

Yes, the rich do have expenses and liabilities, and also rely on earned income to some extent. But the rich make trade-offs that the poor and middle class do not, but focusing on paper and passive income streams.

After organizing personal finances this way, someone intent on becoming rich might rent a small apartment close to work to save on gas and house payments. A car that is paid-off is good (for now), along with the low insurance payments.

The money that does not go to expenses can be used in two ways:

- Placed in savings and retirement accounts (path to frugality)

- Purchasing income generating assets (path to wealth)

Again, both paths are acceptable. The choice is yours.

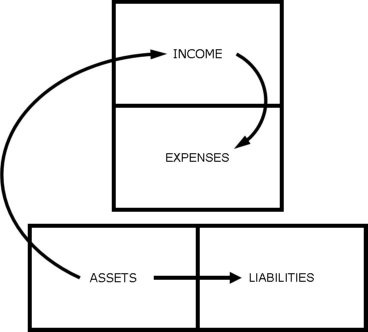

The Cashflow Pattern of the Wealthy

The wealthy are the closest to financial independence that anyone can hope to achieve. As you'll notice in the diagram below, the earned income arrow is gone.

Cashflow Diagram - "The Wealthy" (a.k.a. Financially Independent)

Quite simply, a person can be considered wealthy when all of their expenses are paid by paper and passive income sources.

In other words, this means that YOU NO LONGER NEED A JOB! This is the point at which you move from "earning a living" to just "living".

Have Fun Organizing Personal Finances

The best way to learn about organizing personal finances is to play the Cashflow 101 from Rich Dad. It is similar in concept to Monopoly, making it fun to learn about personal finance and investing for the whole family.And as you get smarter about the game, you can try all sorts of different ways to improve your cashflow pattern and get out of the rat race.

Click here and purchase the Rich Dad Cashflow 101 board game from Amazon.com.