Create High Yield Investments using Covered Calls

YES! Creating high yield investments for yourself is possible.The real question is how much time do you want to spend attaining this goal...

First and foremost, the best way to invest is the one that you are most comfortable with.

If someone told you to buy futures contracts and you knew nothing about futures, it would definitely NOT be the best way to invest for you.

Before We Begin: A Word or Two on Risk

If we were playing a word association game, I'd guess that when I'd say option, you'd say risk.Risk is a relative term. A motorcycle is a bunch of metal and plastic. By itself, it is not risky. But with the wrong rider, it can definitely be considered high risk.

Similarly, stocks, bonds, gold, CDs, mutual funds, ETFs, etc. are not high or low risk by themselves. They are just investments.

Even gold and certificates of deposit can be high risk; if you only had $100,000 to invest and you invested it all in gold, that would be pretty risky.

Your level of risk is created by how you buy something. Take the $100,000 example; if you put 10% of the $100,000 into gold, then you've just limited the "risk" of gold.

Even if the price of gold went to ZERO (which won't happen), the maximum you would lose is the 10% ($10,000) you invested.

This is referred to as position sizing, and should be one of the first things you do as part of your personal money management activities.

You can further limit risk by knowing what events will cause you to buy (price, volume, earnings announcement, etc.) and what events will cause you to sell.

Do some work up front, before you select anything, to manage risk. A starting point is to make sure that each "buy" you make is less than 10% of the total amount you have to invest. This way, if you make a mistake, it won't wipe you out!

Wealthy investors try to keep each investment under 1%!

Also, select the right investment broker and trading account (low commissions, etc.) for the personal finance goals you are trying to accomplish with your trades.

Picking High Yield Investments

So...now that you're ready, it is relatively simple to generate high yield investments using a technique called "covered calls".The key with this technique is to make sure that you buy something that you want to hold for a fairly long period of time (12 months or more).

Also, you want to find something that does not have a lot of price swings (volatility).

This way, you can spend less time worrying about the changes in your account balance (from changes in the investment's price).

But Here's the rub: the lower the price swings, the lower the yield you will make from covered calls.

A Sample High Yield Investment

As an example, I'll assume that you use a stock for the base investment instrument of your high yield investment.So you buy 200 shares of SO (Southern Energy - a utility company). Lets also assume that SO is trading at $34.78 per share.

The cost is $6,956 + commissions.

- Take a look at the total amount you have to invest...how big or small is a $7,000 investment? Do you need to adjust the size at all?

The reason that I selected a utility company is:

- I wouldn't mind holding onto this stock for a while

- The price action of utility company stock is fairly constant

- Under normal conditions, utilities do not go through wild price swings

Selling an Option

Assume that a $35 dollar call option that comes due in the middle of next month (3rd Friday) is trading for $0.40 per share.

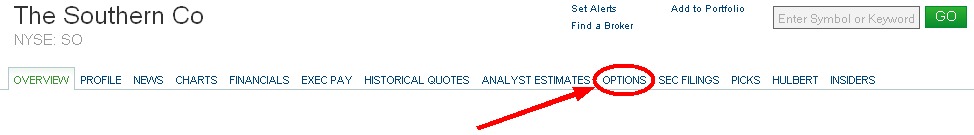

How to find option prices for SO at MarketWatch.com

How to find the $35 call price for SO at MarketWatch.com

Options come in 100 share increments, so you could sell a $35 dollar call option for every 100 shares. In this example, you can sell a total of 2 options.

You have now sold someone in the market the "right" to buy your 200 shares at $35 per share.

In return for putting your shares on layaway for this anonymous person, the anonymous person gives you 0.40 per share. So 200 shares * $0.40/share is $80.00 (less commissions of course).

This is ~1.2% return before commissions. I know that doesn't seem like a high yield investment, but remember that is a 1.2% return per MONTH, for a stock that you want to hold on to anyway.

The Option Comes Due

If the price of SO is lower than $35 in the middle of next month (expiration date), then the option expires and you can sell another option.

If the price of SO is higher than $35, then your option will be exercised and you will your shares at $35. The $80 is yours to keep as well.

But wait, there is more.

Since you bought SO at 34.78, you also get another another $0.22 per share or $44. So in this particular example, someone paid you to make a profit. High yield investments indeed!

You can then buy another 200 shares, and sell another 2 options.

The High Yield in High Yield Investments

This is where you get the high yield.I had an ulterior motive for selecting SO...as an added bonus, SO yields a 5.2% dividend per year! As long as you own the SO shares on the "record date", you will get $1.8/per share, per year. On 200 shares, that is ~$360 per year (or $90 per quarter).

In addition to the 5.2% yield on SO, you will also create ~1.2% yield every month (or a little over 14% per year).

Which means that at the end of the year, you've created a high yield investment with ~19% return! Good Job!

CAUTION!!!

Now I know you're excited. But keep in mind this is a very simple example!It doesn't take into consideration taxes at the end of the year, the total level of commissions, etc. Keeping your money in the market for an entire year is a long time!

Research, financial planning advice, and time spent studying options is required. I suggest paper trading for AT LEAST 4 months before you even consider trying to create your own, high yield investments using covered calls.

To help you get started, check out the Chicago Board Options Exchange (CBOE). The company is the world's largest options exchange and has a huge number of resources for you.