What You Need to Know About Gold Investment

During times of economic uncertainty, gold investment and investing in precious metals becomes a very popular topic in the financial news.Gold investment is one way that people ease their fears by trying to preserve the value of their portfolios.

But is it right for you? I'll cover the basics (what is gold), common reasons for buying it, factors that affect the price you will pay, as well as some recommended starting points for your research.

What is Gold?

In it's physical form, gold is a naturally occurring element, called a precious metal (an element that is rare and has a high economic value), with many industrial applications.

From a financial perspective, gold is part of the asset class called commodities.

A commodity (such as salt or lumber) is an asset that has the same properties, regardless of the source.

Gold may have different purities, but gold is gold, regardless of where in the world it was mined.

Before the introduction of "fiat" currencies (e.g. the paper money most of us use today), physical gold was used as a financial tool to pay for goods and services.

Since the value of most paper currencies is no longer linked to the price of gold (called the gold standard), the "value" of a dollar comes from the issuing governments' ability to repay debts.

This is the reason paper money is called fiat currency. Fiat means "an arbitrary decree or pronouncement, especially by a person or group of persons having absolute authority to enforce it".

Safe Investing Tip:

The influence of gold as a currency can still be seen today on US coins. The notches on the sides of most coins were originally used to prevent "shaving" the edges of gold and silver coins. Even though there is little gold or silver in today's coins, the notches remain.

Why buy Gold?

Investing in gold is part of a preservation of capital investing strategy.

During times of financial crisis, low interest rates and inflationary monetary policy can reduce purchasing power. Bank failures complicate the situation by making it difficult for you to access your savings.

People begin to fear that they will need more paper money to buy the same amount of food, clothing, shelter. So they view gold as a "value storage" device, meaning that a gold investment is a way to preserve (i.e. store) the purchasing power (i.e. value) of their investing portfolios.

Most investors have this "reactionary" view of gold. What I mean is that gold investments are made on a short term basis, in reaction to current market conditions (verses part of a long-term strategy).

A smaller number of investors think of gold as "insurance". These people have a certain percentage (usually less than 10%) of their net worth in physical gold. Their gold investments are part of a buy and hope strategy; they buy it and hope they never have to use it.

The gold acts an insurance policy against a financial meltdown. In extreme situations, called hyperinflation, cases, a paper currency can become essentially worthless. In the event that a paper or fiat currency loses all its value, their gold can be used to buy goods and services.

Factors that Affect Price

Fundamental analysis is one way to gauge the factors that affect the price of gold (interest rates, rate of inflation or deflation, other commodity prices, GDP, etc.).

The actual level of gold production, changes in global supply, and other macroeconomic factors are all rolled up into the price.

Since gold is a "fungible" substance, spot price changes are mainly driven by supply and demand.

The spot price is simply the current market price for a standard quantity of a commodity. All gold investments are affected by the spot price.

Fungible means that 1 oz. of gold can be interchanged with another 1 oz. of gold of the same purity without changing the value).

Given the fact that supply is fairly constant (as of 2009, the amount of gold refined each year is a very small percentage of the overall amount of gold available in the marketplace), demand plays a much larger role in determining gold prices.

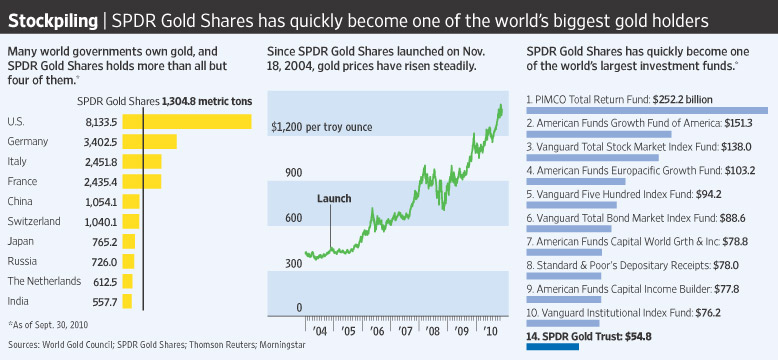

Governments and their respective banking systems can influence gold prices because of the HUGE size of their gold holdings, as well as selling agreements (restrictions) between various nations.

SPDR Gold Shares - One of the world's biggest gold holders - WSJ.com

Click for a larger image

Technical analysis (spot price data over time), is another way to determine when to start or stop investing in gold.

Gold is readily accessible by private investors (i.e. a very liquid market), prices have the potential to change rapidly. This price volatility is easy to see with technical analysis, but may not show up in the fundamentals.

Investing Choices

Be sure to visit the page investing in precious metals page, because gold investments have several aspects that are identical to other precious metals such as silver and platinum.

Real Assets

- Collectible Coins

- Bullion (Coins and Bars)

- Jewelry

For gold bullion, the standard quantity is 1 oz.

Gold coins are valued by their mass and level of purity. 99.9% purity is the most common form of gold bullion (the highest level currently available is the Canadian Gold Maple Leaf at 99.999% purity).

Financial Assets

- ETFs

- Mutual Funds

- Gold-based stocks (Mining, refining, etc.)

- Trusts and Partnerships

Where to buy Gold Investments

Gold investments can be made at many locations; the type of investment you choose will narrow your options.

Physical assets, such as collectible coins and gold bullion, can be purchased at rare coin dealers in your local area, or online auction houses if there is nothing close to you. For starters, check out the U.S. mint website (www.usmint.gov).

As with all online vendors, you MUST do your research to ensure that these dealers are reputable. After a weekend of searching, I found USA Gold (www.usagold.com). What attracted me to this company was their A+ rating from the Better Business Bureau.

It also pays to shop around. Even though gold is gold, all gold mark-up's are not created equal. There are volume discounts for large purchases, shipping considerations, and/or storage fees (depending on where you keep your gold). The amount you buy has a significant impact on the mark-ups you'll pay, and there are differences in the level of customer service.

I recently discovered that John Mauldin, a well known investing expert, has a long time friend at the Perth Mint (www.perthmint.com) who may be able to help you:

- And one of their dealers is an old friend of mine, Mike Checkan of Asset Strategies International. I have known Mike for about 30 years, and he does what he says and shoots straight. He is well-known in the investment information world, with lots of endorsements. You can learn more about his outfit at www.assetstrategies.com or call them toll-free at (800) 831-0007 in the U.S. and Canada, or direct at (301) 881-8600. You can also email them from their web site.

Financial assets, such as gold-based funds (such as the gold ETF GLD) and/or the stocks of gold mining companies, can be purchased in your investment broker and retirement investment accounts. For more information on trading accounts, click here.