The Expense Ratio: Your Key to Fund Investing

The expense ratio is a mutual fund investor's best friend.

It gives us a way to directly compare many different funds at the same time, because it is calculated the same way for all of them.

We can compare how well an investment company is using our hard earning money and weed out those that do not have our best interests at heart (i.e. spend a lot of our hard earned dollars paying someone to manage a fund).

What is the Expense Ratio?

At a very high level, it tells you how efficiently the fund is run. This is because it looks at the costs of running the fund relative to the size of the fund.

Technically speaking, the ratio is the combination of the 12b-1 fee, the management fee, and the "other" fee, divided by the average net assets of the fund. And yes, the "other" fee is actually a category.

The fund's board of directors reviews the management fee annually, and shareholders are required to vote if an increase in proposed.

Of the flip side, the fund manager or investment firm can reduce certain fees, subsidize them, or get rid of them all together in order to improve their ratios.

Why is It Important

By itself, the it isn't that important; it is just a number. The ratio becomes helpful when you compare two funds that invest the same way.

Your 401k may offer you several different ways to invest in small cap stocks, for example. Granted, the investment firms that run each fund will have a slightly different strategy. But that is out of your control. Which fund you choose is totally within your control.

Since fee's are taken out of a fund's assets on a yearly basis, part of your yearly profits are taken away. So remember Safe Investing Principle #7 - Constantly pursue ways to reduce costs.

How to Use It to Make Investing Decisions

The greatest thing about the ratio is how easy it is to use when making investment decisions.

The lower it is, the better the fund is for you.

As the ratio gets smaller, that means that less of your money is going towards running the fund. Which in turn, means more of the funds profits are going into your pocket.

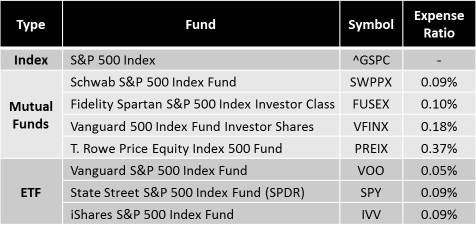

An easy way for you to make the comparison is to make a table. Below is one that I created in about five minutes including formatting!

As you can see, each fund has a different level of expenses, even though each one is supposed to do the same thing (measure the performance of the large capitalization sector of the U.S. equity market).