A CD Ladder creates Consistent Income

Making a CD ladder is an investing technique using certificates of deposit. You can use it to generate income or increase the interest you get on your cash reserves.

A quick refresher on how certificates of deposit work:

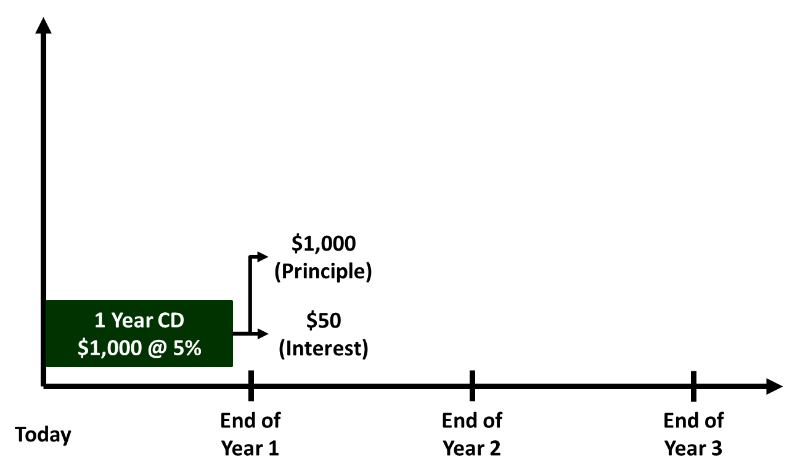

- When you buy a CD, you are giving your money to a bank for a specified period of time, in exchange for interest payments.

- This is similar to an interest bearing savings account, except you will not be able to use the money until the CD matures.

- If you purchase a 1 year CD, then you do not have access to your money for 1 year, in exchange for the interest payment.

Click on this link if your looking for information on CD investments by themselves.

What is a CD Ladder

The concept of a CD ladder is based on buying several certificates of deposit, using the money over and over and over again.A CD ladder usually involves buying CDs that mature two or more years from today.

Why?

The main reason is the interest rate. Long duration CDs have higher interest rates than short duration CDs. The banks must give investors a higher rate if their money is going to be locked up for a longer period of time. The longer the lock-in period, the more they have to pay you.

A secondary reason to use longer duration CDs is to lock in high interest rates. After the 2008 market crash, rates remained low for some time. So it wouldn't be wise to lock in rates for a long time. If interest rates rose, you would miss out on the higher interest payments.

On the other side, if interest rates were high, then you would want to use longer duration CD's and lock in the high rate for a longer period of time. That way, when interest rates fall, you will still have the higher interest payment.

How to build a CD Ladder

First things first: how much money do you want to lock up using this technique?Lets assume you have $2,000 to invest. Second, take the total amount and divide it by the length of time you want to have it locked up.

Lets also assume that I am OK with having my money locked up for 4 years; that gives me $500 per CD.

- Typically you invest an equal amount of money into each CD each year, because it will be easier for you to remember (saving you time).

Third check into the CDs you're going to use.

- Look for the best interest rates. Back in the day, this meant going around to local banks and asking. Now, you can do the search online.

- Once you find the best interest rate, find out if there is an minimum investment, and figure out if the CD fits into your plan.

If the CD I want to use has a $1,000 minimum investment, then I need to find a CD with a lower minimum, change the amount I am investing, or the period of time.

Since I may need the money to pay down my mortgage, I'll go with 2 years instead of 4. That will allow me to meet the minimum investment of $1,000 per CD.

You actually buy the CDs for a ladder in two steps:

- Buy several CD's with DIFFERENT durations (e.g. 1 year, 2 years, and 3 years).

- As the CD's mature, reinvest the money into CD's with the SAME duration (e.g. three 3-year durations).

Each CD you purchase, from short to long-term, represents a step of your CD ladder. Every time your shortest CD matures, you have the choice to move up the ladder by purchasing a new, longer-term CD. You’ll benefit from longer-term rates, while retaining the option to choose a different investment if your goals have changed.

This can help you optimize your yield, while still providing flexibility and choice.

The timeframe that you select also tells you the duration of the CDs you'll be buying. When I selected 2 years as my ladder duration, that means I will by buying 2-year CDs.

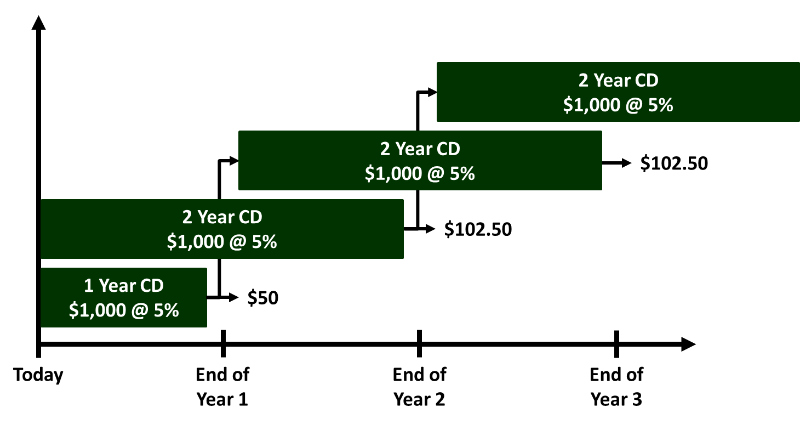

Here's how that plays out:

- Year 1 - Buy 2 CDs - One for 1 year, and one for 2 years.

- Year 2 - Your 1-year CD matures. You take the principle from that CD and buy a second 2-year CD.

- Year 3 - Your first 2-year CD matures. You take that money and buy a third 2-year CD

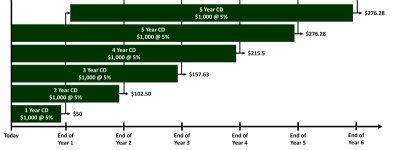

If we go back to our example and change the total amount from $2,000 to $5,000, then I would be buying 5-year CDs.

- Year 1 - Buy 5 CDs - One for 1 year, one for 2 years, one for 3 years, one for 4 years, and one for 5 years.

- Year 2 - The 1-year CD matures, so I take principle frmo that CD and buy a second 5-year CD.

- Year 3 - My 2-year CD matures. I take that principle and buy a third 5-year CD.

- Year 4 - My 3-year CD matures. I take that principle and buy a fourth 5-year CD.

- Year 5 - My 4-year CD matures. I take that principle and buy a fifth 5-year CD.

- Year 6 - My first 5-year CD matures. I take that principle and buy another 5-year CD.

In both cases, you have a CD maturing every year. And now you can see the benefit of the 5 year ladder. Once it is rolling, your yearly interest payments are a lot higher than the 2 year ladder, because you are getting 5 years worth of interest payments each year. It takes a little longer to set-up, but you can see the benefit.

If you have the time, you can also set up 2 or 3 shorter term CD ladders (say 3 different 2-step CD ladders), and accomplish similar results.

What to look for when building a CD Ladder

This technique allows you to earn competitive rates and maintain a level of flexibility and liquidity while having the protection of FDIC insurance.FDIC Insurance

- When you invest in bank CDs, your money is insured by the FDIC.

- Do you homework. Look at CDs issued from a variety of banks to make sure that you are getting competitive terms and interest rates.

- You should not be charged with any kind of fee for setting up a CD ladder. If you hear otherwise, take your money somewhere else.

Benefits

Generate consistent income- With a variety of maturity dates in your ladder, you will have several CDs paying interest on a regular basis to support an income strategy.

- By investing your cash in different maturity dates, you’ll have CDs coming due regularly and cash available at consistent intervals if needed.

- A CD ladder with different maturities allows you to maximize yield and cushion against big swings in interest rates.

- If interest rates go down, you’re locking in higher rates with longer-term CDs.

- If interest rates go up, money from your maturing CDs can be reinvested at the higher rates.

On May 20, 2009, the temporary increase in FDIC insurance limit from $100,000 to $250,000 per depositor was extended to December 31, 2013. Visit www.fdic.gov for more details.

Drawbacks

Liquidity (i.e. access to your money)- There may be costs associated with early redemption and possible market value adjustments.

- Brokered CDs will fluctuate in market value between purchase date and maturity date due to their ability to be sold on the secondary market. While the secondary market for CDs is generally illiquid, a significant loss of principal could result if your CD is sold prior to maturity.

- Carefully consider the tax consequences as well as any fees and charges that may be imposed upon liquidating a current investment.